Why Traditional Business Lending Doesn't Work For Todays SME Businesses

Traditional Loans

- Lots of information required - including business plans, cash flow forecasts and more

- Fixed amounts to repay - So if you are having a slow month you still have to find the loan repayment payment.

- Home or assets required as security

- Slow loan application and decision process

- Less than you need often offered

- Early repayment fees

- High interest rates

- Non flexible fixed loan term duration

Cash Advance Loans

- Easy application Process

- No business plan or cash flow required

- Quick decision

- High approval rate - 90%

- You are dealing with an understanding lender who accepts you may not have a perfect credit score

- The loan is flexible so if your business is going through a dificult patch then you pay less

- Option to get more later - Easy renewal process - Money in 24 hrs

- Competitive interest rates

Get An Offer Of Funding... Fast

See Why Cash Advance Loans Have Become The Loan Of Choice

Why Cash Advance Loans Are So Popular

CAL – Is quickly

becoming the most popular form of fast, effective SME finance across the UK and Europe.

CAL – Is the most flexible, cheapest and fastest type of business loan available.

CAL – Quick application process – Get your funds in days – sustain your cash flow.

CAL – Simplicity, and Affordability

CAL – Repayments track your business success so you never pay more than you can afford.

CAL – FLEXIBLE, RESPONSIVE LENDING

Funding For Your Business In 3 Easy Steps

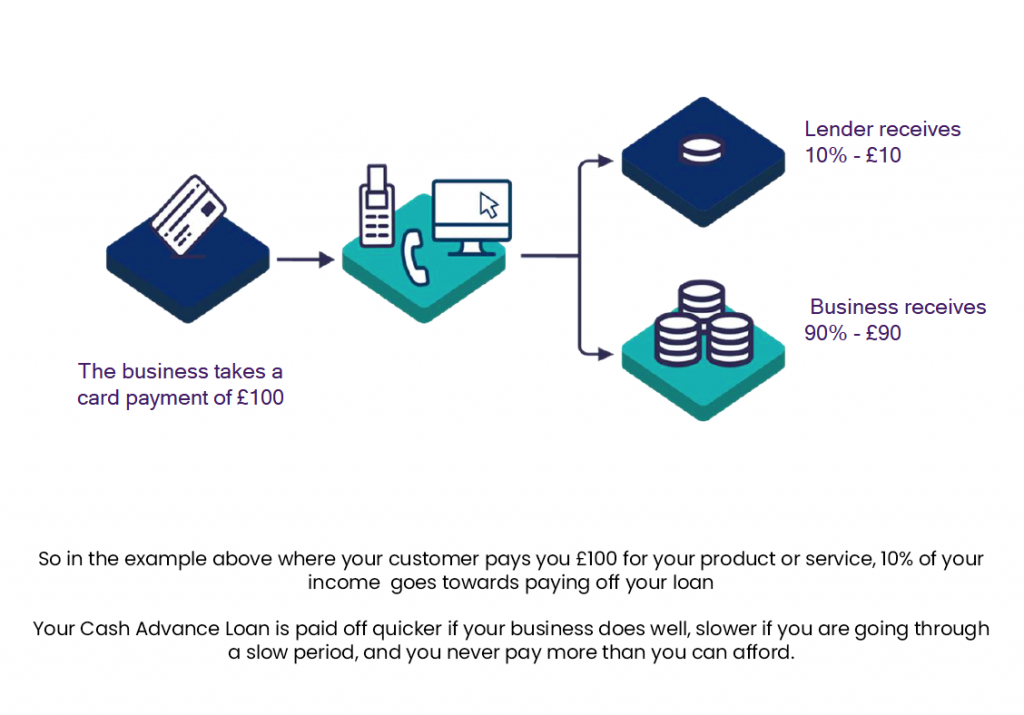

Repaying Your Loan

Repaying Your Loan

Case Study