Fast, Affordable Business Lending

Get the money you need!

£10,000 – £300,000 Apply Today

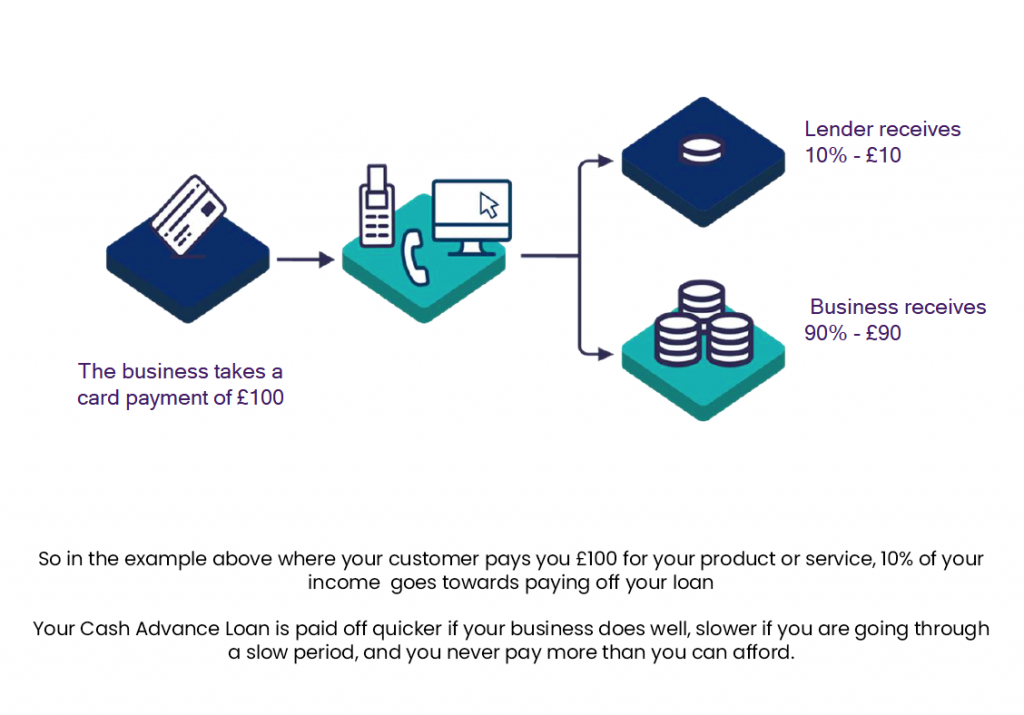

Fund Your Business From The Payments You Take From Your Customers When They Pay You Using Their Debit or Credit Cards.

Best Of All You Only Pay What Your Business Can Afford, Paying The Loan Back Little By Little.

90% Approval Rate

Decision In As Little As 24 Hours.

Why Traditional Business Lending Doesn't Work For Todays SME Businesses

Traditional Loans

- Lots of information required - including business plans, cash flow forecasts and more

- Fixed amounts to repay - So if you are having a slow month you still have to find the loan repayment payment.

- Home or assets required as security

- Slow loan application and decision process

- Less than you need often offered

- Early repayment fees

- High interest rates

- Non flexible fixed loan term duration

Cash Advance Loans

- Easy application Process

- No business plan or cash flow required

- Quick decision

- High approval rate - 90%

- You are dealing with an understanding lender who accepts you may not have a perfect credit score

- The loan is flexible so if your business is going through a dificult patch then you pay less

- Option to get more later - Easy renewal process - Money in 24 hrs

- Competitive interest rates

Get An Offer Of Funding... Fast

See Why Many Business Are Using Cash Advance Loans To Raise Finance

Why Cash Advance Loans Are So Popular

CAL – Is quickly

becoming the most popular form of fast, effective SME finance across the UK and Europe.

CAL – Is the most flexible, cheapest and fastest type of business loan available.

CAL – Quick application process – Get your funds in days – sustain your cash flow.

CAL – Simplicity, and Affordability

CAL – Repayments track your business success so you never pay more than you can afford.

CAL – FLEXIBLE, RESPONSIVE LENDING

Funding For Your Business In 3 Easy Steps

Repaying Your Loan

Repaying Your Loan

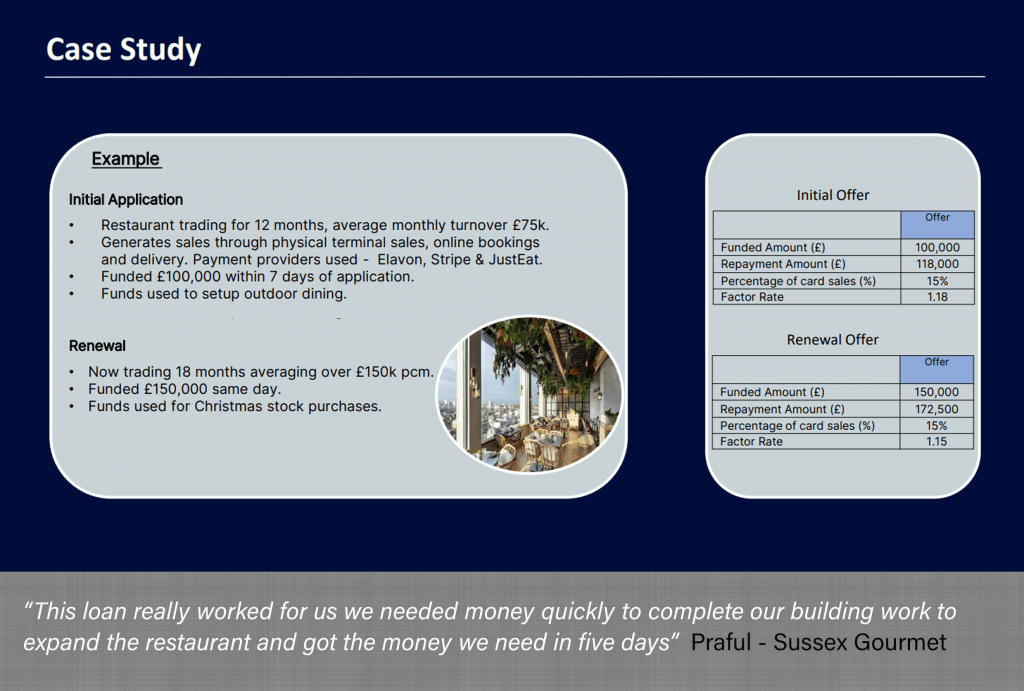

Case Study